Contract Employee Tax Form For Employer – If you’re a worker and so are unclear what you should fill out on the taxes types for workers kinds There is something you have to be conscious of. You should be familiar with the name from the workplace, their state Withholding allowances, the State, and also the expected date from the forms. Back then you finish this article, you’ll be able to master the basics. You need to by no means miss out on something! We’ve ready this article that can assist you in your vacation. Contract Employee Tax Form For Employer.

Workplace

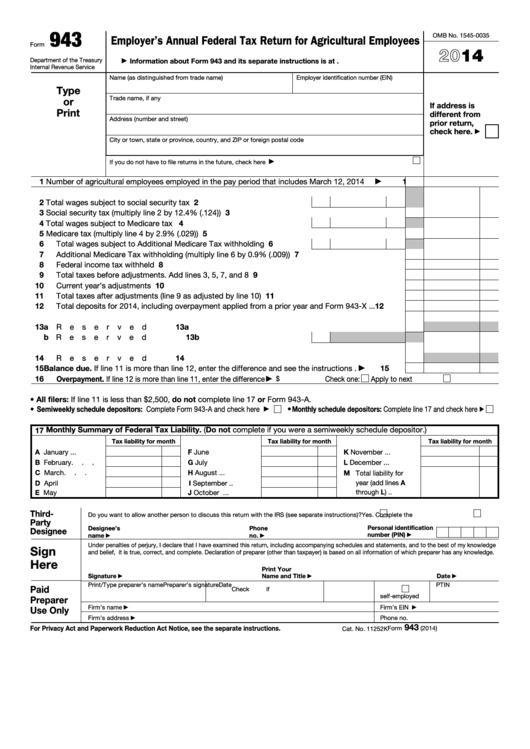

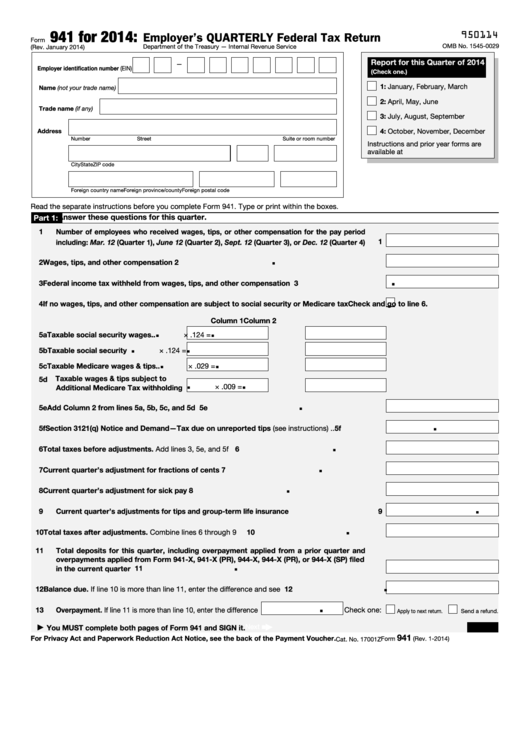

Employers For an boss, you need to be familiar of your a variety of taxation varieties along with the deadlines to submit the kinds. Kind 940 is definitely an twelve-monthly form which calculates the government fees you spend on employment. If they make payments to employees exceeding $1500 or give them some time for more than 20 weeks, employers are required to complete this form every year. Type 941 is undoubtedly an twelve-monthly kind that details the income tax in addition to Interpersonal Stability taxation withheld from your employee’s income. The form also databases just how much FUTA taxes you need to pay out. FUTA taxes must be paid annually from your company, and also the develop will probably be helpful to submit the tax for your Internal revenue service.

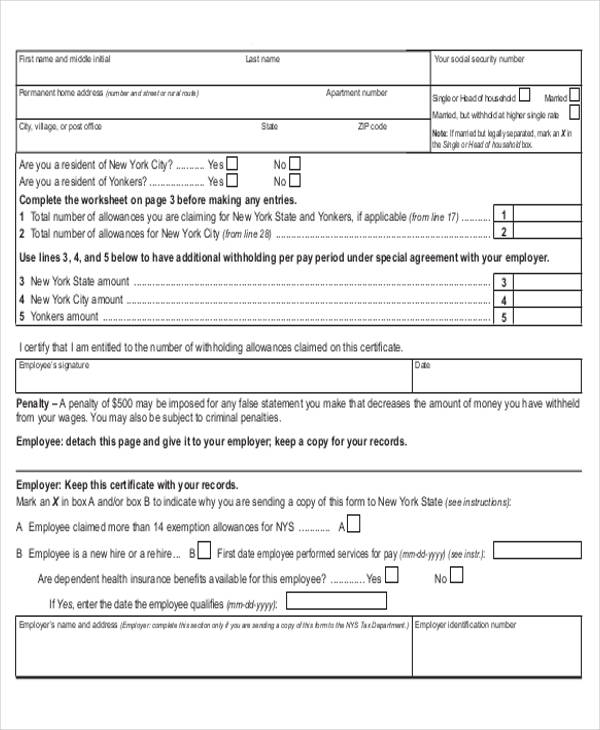

If you’re a new employer, it’s crucial to fill out the proper forms. In Container B, Type IT-2104 notifies businesses what level of New York City Condition and Yonkers taxes they may withhold. The greater number of allowances a staff member is eligible to, the a lot less income taxes they are withheld. Pack D contains any other papers relevant to taxes. It is also necessary so as to document any expense or revenue boasts the staff member posted. You should use the form DE 1378A is to be utilized if the self-employed worker is employed. You must make use of the form DE 1378DI if you are a business with LLC members or partners who manage the company.

Status

The State of Personnel Tax kinds are officially needed to be completed and handed to companies. These kinds must be filled out by brand new employees to verify that they’re qualified to be used. The details you give enables you to estimate payroll for workers. Apart from national varieties employers might be asked to collect taxation from your status on varieties. As an illustration, companies who are positioned in Washington DC Town of Washington DC must record earnings earned from the town on taxes forms. This really is a short information concerning how to fill out the taxes types for workers who are employed in that City of Washington DC.

Businesses must complete condition W-4 forms each year for each new personnel. In order to ensure that the appropriate amounts of tax owed by the state are deducted from their wages, these forms are required to be filled out by employees. These types are like those of the usa Form W-4 they may be utilized by employers and employees to calculate the quantity of taxation owed. Some suggests might need another kind being accomplished to protect distinct conditions. In this situation companies have to ask with all the individual assets section of the firm to make sure they already have every one of the needed condition forms are updated and precise.

Withholding allowances

Once you document your government taxes, you might need to supply information about the allowances for withholding. It is because particular reductions helps to reduce the volume of estimated taxes-insurance deductible earnings you state. The computations accustomed to estimate withholding allowances take into account the write offs. In the case of declaring not enough allowances, it could cause the payment of any reimburse. It could result in tax debt when tax season comes around if you claim too many allowances. Make use of your W-4 Calculator to determine how your allowances affect your income tax commitments.

You may easily determine the federal withholding income tax factor category by researching the guidelines which can be in Form W-4. You may then adjust the amount withheld to be sure that neither of them you or maybe the demanding authority be forced to pay an past due stability at the close each year. The decision to lessen your income tax deduction basically is contingent on the amount of your earnings are low-salary. You can pay estimated tax monthly payments for Tax Department if you don’t have to pay the entire amount of your earnings. Tax Section.

Expected particular date

The deadline for supplying workers with taxes types is around the corner. Before January 31st 2022, form W-2 has to be handed out to employees. Staff who cease functioning before the timeline may still purchase an authentic variation from the type. If not, the employee has to ask for a copy of the form in the first 30 days of making a request. If, nonetheless, the staff member requests a duplicate before expiration time, companies should send the shape to the employee. The timeline for distributing the forms is additionally established by the day the staff member constitutes a request for it.

The Internal Profits Assistance (IRS) has tough suggestions for that distribution to staff members in the develop W-2 type. At times, it really is referred to “Income and Taxation Statement,” this kind is used by companies to document the salary staff members receive and also the fees which can be subtracted using their wages. Businesses are needed to total and send the shape to all staff from the 31st of January to enable workers time for you to complete taxes. Moreover the form is undoubtedly an info provider which can be used by employees in the Sociable Stability Supervision.

On the internet accessibility

Employers have the ability to offer staff members with convenience to W-2 tax varieties on the web. When an employee is signed up into the process and it has joined they will be alerted by means of e-mail informing them that this taxation forms are offered to obtain. Ahead of installing tax types make sure you authenticate your home street address and also private current email address with UCPath online. On January 10, 2022 most employees must have the two Kinds W-2 types in addition to 2 1095-C varieties. You are able to see the W-2s and also 1095-C varieties through At Your Service On the internet.

Given that final Fri, businesses who allowed staff members to conceal their Kinds W-2 should be receiving a computerized e mail that integrated recommendations on the way to open up the varieties. If employees did not consent to the suppression of their W-2s, the paper Forms can be printed out and delivered on or before the 31st of January. There is lots of time to omit Types 1095-C as well as W-2. Whilst you hang on, it’s still possible for employees to obfuscate their tax types via producing an internet tax return.