E Kentucky Form K-4 Employee’s Withholding Exemption Certificate – Perhaps your enterprise has recently modified your worker withholding Develop (also referred to as”the W-4) making it easier for employees to comprehend and submit their tax returns. But, this modification could cause confusion to workers because they might not exactly know where to find the very last year’s private earnings for taxes. To get the info, you may well be needed to look at the employee’s private taxes give back. To create the entire process of processing your taxes a lot more basic our recommendation is that you browse the Nationwide Payroll Revealing Consortium’s guidelines. E Kentucky Form K-4 Employee’s Withholding Exemption Certificate.

IRS Kind W-4

This is basically the IRS Type W-4 is a kind of taxation develop hired by organisations to decide the level of tax withheld from your paychecks of employees. It is separated into two portions: a Worksheet and also the Recommendations. The Worksheet provides the information you need to estimate an employee’s allowance for withholding for first time York Yonkers and State taxation. Directions require a calculation of wages which are in the range of $107650 to $2263,265, if married couples file conjoint returns.

The up to date Develop W-4 doesn’t require staff members to supply the exemptions they may have for their own reasons or exemptions for dependents. As an alternative, it openly asks for the volume of dependents they may have as well as the amount these are qualified for assert for every dependent. It also asks if the employees wish to increase or decrease the amount they withhold. Given that the information is correct it can result in a tax withholding quantity under precisely what is basically thanks after it is time for you to document income taxes for the year.

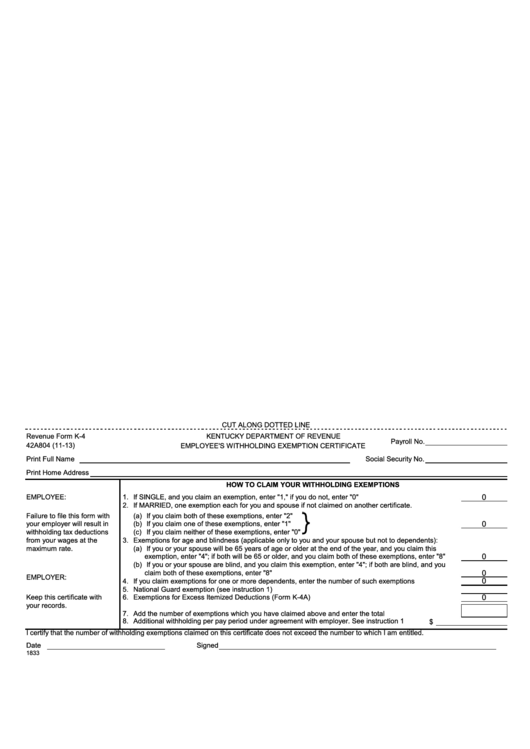

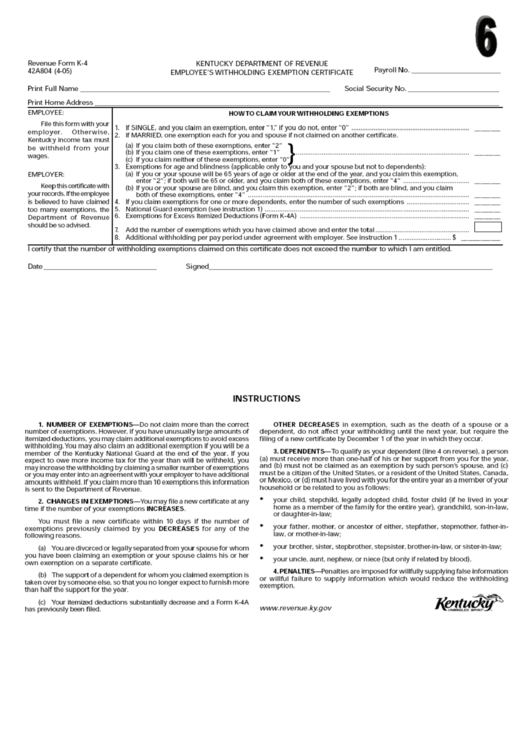

Forms for withholding state tax varieties

You have to supply your employer with condition tax withholding types for workers annually. The types will be required any time you start your new career. They will be analyzed every year to ensure you take the correct level of tax. The government W-4 will be the typical develop each staff needs to fill in however, states’ kinds fluctuate somewhat. You can contact your HR department if you’re not certain what forms are required in your state. Ask the HR department of your company or your employer if you’re not sure if you’re required to fill out State Tax Withholding forms or not.

Particular claims require companies to deliver employees with taxes withholding varieties which can may help them know which taxation they must pay inside the status they can be found. Based on the state, you might have to accumulate details about a few types of taxes. It is actually necessary to disperse the federal and state W-4 forms to every employee. Taxes withholding express kinds to staff members related with government W-4 types nevertheless, they may include particular information. Keep the kinds in the protected place and update them regularly.

Exemptions from withholding national income tax

There are lots of tax withholding exemptions available to staff members. The worker who lacks to pay for taxes must not possess any taxation-insurance deductible revenue in the previous 12 months and get no intention of making taxable revenue within the current calendar year. Other exemptions to withholding for employees are partners who have kids under 17 years old, and who do not qualify as dependents by a person else’s taxes. But, you can not claim each and every exemption you will find. The exemption has to have to be applied for on a brand new Form W-4 each year in order to remain on good terms.

The W-4 form will be in influence on January very first 2020. Businesses may use the shape to tell companies they are not at the mercy of withholding tax on national revenue. To get exempted, the staff member ought not to be liable for income tax before calendar year, or predict having an income tax responsibility to the season in which they are employed. The Shape W-4 declaring exempt from withholding is simply reasonable for your calendar 12 months which it is actually granted. If an employee wishes to retain this exemption, a fresh Form W-4 has to be provided to their employer before February 15th of the following year.

Output deadlines for your filing of types

The Internal Earnings Assistance (IRS) decides about the requirements for filing withholding each year by looking at your accounts spanning a 12-calendar month period of time. The time frame for the schedule season is about the 31st of January. The following are the crucial schedules to submit the varieties. To make certain that you’re in concurrence using these guidelines adhere to the work deadlines listed here. It really is possible to complete these kinds on paper or on the web form. In either case, make sure that you document them with the deadline.

You must complete Form 1040 before the deadline if you’re an U.S. citizen and live outside of the United States. If you’re a non-resident alien and are currently serving within the military then you have to complete Form 4868. Form 4868 in order to delay the deadline to October 15, 2019. Furthermore those who are in a conflict zone may request an extension of four months in order to make it through the deadline.