Employee Wage Withholding Form California – Probably your company has transformed your personnel withholding Form (also referred to as”the W-4) to make it much easier for employees to comprehend and submit their tax returns. But, this change could cause uncertainty to employees as they might not know where you should identify the last year’s individual profits for taxes. To get the data, you might be needed to analyze the employee’s private taxes return. To help make the process of submitting your tax return a lot more easy it is recommended that you look at the Countrywide Payroll Revealing Consortium’s rules. Employee Wage Withholding Form California.

IRS Form W-4

It will be the Internal revenue service Develop W-4 is a very common taxation kind employed by employers to determine the volume of tax withheld from your paychecks of workers. It is actually split into two sections: a Worksheet along with the Instructions. The Worksheet offers the necessary information to calculate an employee’s allowance for withholding for brand new York Yonkers and State income tax. Directions require a calculation of wages which are in the range of $107650 to $2263,265, if married couples file conjoint returns.

The current Kind W-4 doesn’t demand workers to provide the exemptions they may have for themselves or exemptions for dependents. Instead, it requests for the quantity of dependents they already have along with the volume they can be qualified for declare for every dependent. If the employees wish to increase or decrease the amount they withhold, it also asks. Given that the info is accurate it can result in a tax withholding quantity below exactly what is actually expected when it is time to file taxation to the 12 months.

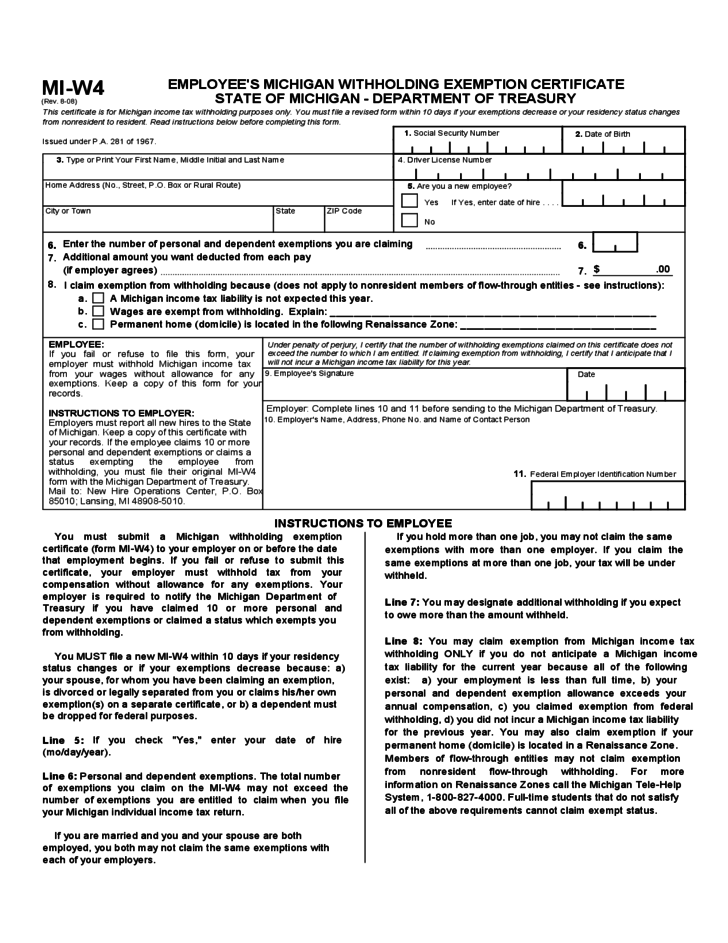

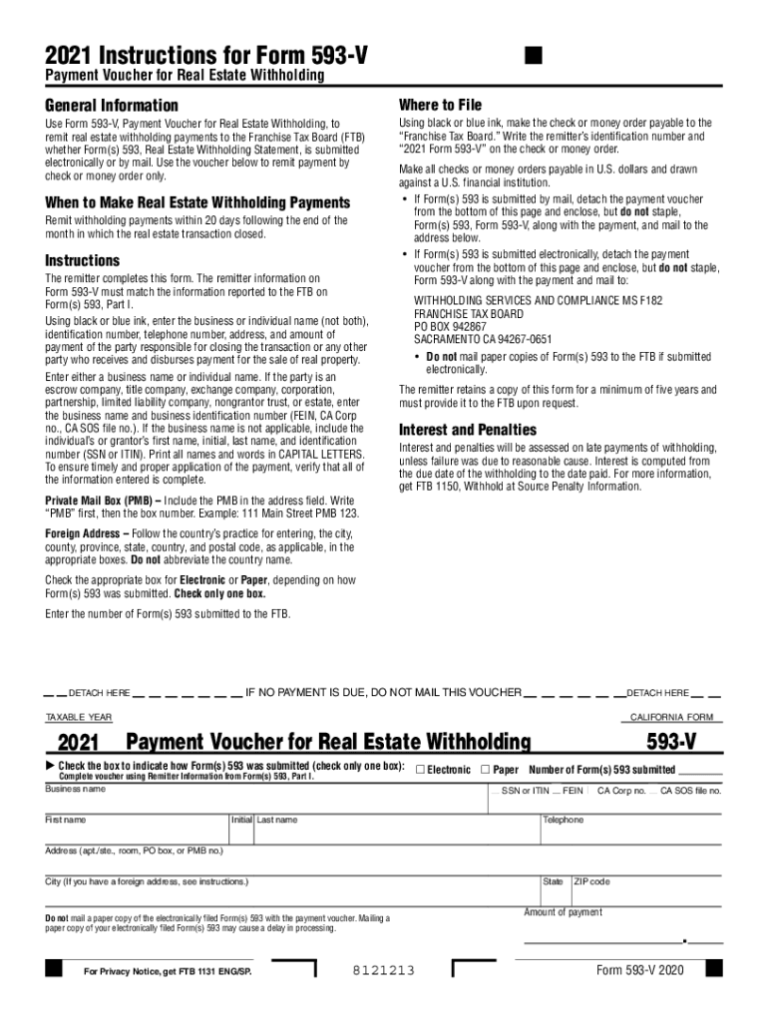

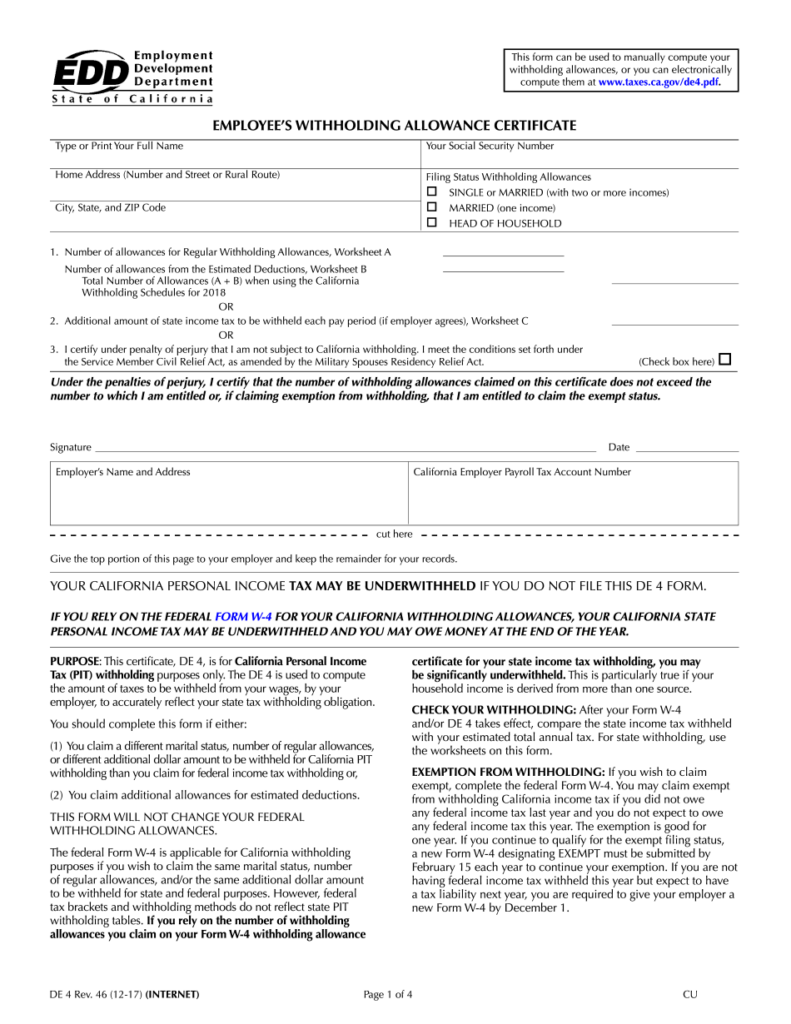

Forms for withholding express taxes kinds

You need to provide your company with condition income tax withholding varieties for workers each year. The types are needed every time you begin your new career. They should be reviewed each year to ensure you take the proper volume of taxation. The federal W-4 will be the typical type every single worker has got to fill in even so, states’ varieties be different somewhat. If you’re not certain what forms are required in your state, you can contact your HR department. Ask the HR department of your company or your employer if you’re not sure if you’re required to fill out State Tax Withholding forms or not.

Certain suggests demand employers to supply staff with taxation withholding types which could can help them know which taxation they need to pay inside the condition these are located. Based on the condition, you could have to gather information about a few types of tax. It can be needed to distribute the government and condition W-4 kinds to every single employee. Tax withholding status types to staff related with federal government W-4 varieties nonetheless, they may have specific info. Retain the varieties within a protected spot and up-date them frequently.

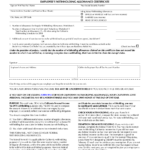

Exemptions from withholding federal government tax

There are lots of taxes withholding exemptions available to staff. The worker who lacks to pay for income tax should never possess any tax-deductible cash flow from your earlier calendar year and possess no aim of generating taxable earnings in the provide 12 months. Other exemptions to withholding for employees are couples who have little ones below 17 years old, and who do not meet the requirements as dependents by an individual else’s tax return. But, you can not claim each and every exemption you will discover. The exemption has to have to be applied for on a brand new Form W-4 each year in order to remain on good terms.

The W-4 type will be in influence on January first 2020. Organisations may use the shape to inform employers they are certainly not at the mercy of withholding taxes on federal income. To be exempted, the employee really should not be responsible for taxes before season, or predict through an taxes requirement for that year by which they may be utilized. The Form W-4 proclaiming exempt from withholding is only valid for your calendar year which it really is released. A fresh Form W-4 has to be provided to their employer before February 15th of the following year if an employee wishes to retain this exemption.

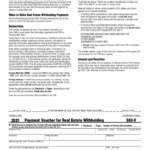

Deadlines for your declaring of types

The Interior Income Support (IRS) decides around the specifications for declaring withholding annually by examining your accounts across a 12-four weeks period. The due date for the work schedule year is in the 31st of Jan. Listed below are the crucial dates to submit the types. To ensure you’re in conformity using these rules adhere to the output deadlines further down. It is actually easy to complete these forms on paper or on the internet type. Either way, be sure that you document them by the deadline.

If you’re an U.S. citizen and live outside of the United States, you must complete Form 1040 before the deadline. If you’re a non-resident alien and are currently serving within the military then you have to complete Form 4868. Form 4868 in order to delay the deadline to October 15, 2019. In order to make it through the deadline, furthermore those who are in a conflict zone may request an extension of four months.