Hm Revenue New Employee Form – If you’ve just recently crafted a retain the services of You might be seeking a place to begin the primary new job Types. Start out with Type I-9, Kind W-4, or even the TP1015.3-V. If you’re unsure the form you’ll need, check out the below links. Soon after you’ve completed the latest Types for Employees Types then you can actually move onto the subsequent phase of using the services of the worker. Hm Revenue New Employee Form.

Type I-9

You will need to complete Form I-9 for new hires if you’re looking to hire new employees. Develop I-9 for workers that are new. To accomplish this it is actually necessary to verify the identification of your new staff. It is a legitimate requirement in federal government rules and you’ll will need one of several two tools presented by the government: The Shape I-9 and also the E-Validate process. Should you not use one of those devices it can be feasible to utilise the mixture of both.

Current version of I-9 for workers who happen to be a new comer to the business finishes on March 31, 2016. You must keep it in use till the updated form becomes available or wait until additional guidelines are issued if you plan to keep using it. The end date of the form on the form itself, or on the USCIS website. If you’re not sure the current version of Form I-9 will be valid for you, consult an employment lawyer for a review of the latest Version that is on the form.

Businesses, you must be sure that the details on Type I-9 is appropriate. Develop I-9 is appropriate. He or she should correct the error if the employee has made a mistake in Form I-9. Form I-9, then he have to date and sign the correct kind. Failure to comply with federal government rules might be a reason for penalty charges. To guarantee the reliability of Kind I-9, ensure that we now have copies in the your documents. Once you hire someone that doesn’t have all the previously mentioned documents it is recommended to hire person who has them.

Form W-4

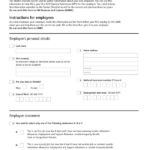

If you’ve recently begun at a brand new position, then you’ll have to fill out a brand updated Form W-4. When a member of staff is moved to new work or goes through an amendment in circumstances and circumstances, the Form W-4 needs to be modified. The IRS obliges people to pay their taxes in slow payments throughout the year, which means if there’s excessive in taxes that are withheld from your salary and you are unable to pay it, you could be paying a substantial amount in April, not forgetting interests and penalty. It’s necessary to adhere to the timeline, no matter what regardless of whether you’re a brand new employee or perhaps existing one.

The form is required to be filled out after which sent to the income tax agencies that are proper. Inside the NYS Taxation Division, W A Harriman Campus, Albany, NY 12227-0865, calls for businesses to send out an original backup of the type to the IRS. Container B have to contain information about how to handle new workers. If the employer is unable to deliver the form through U.S. mail, he or she must consult Publication 55 for further information. The IRS has an estimator of income tax withholding to help you staff members estimate their withholdings.

The form should also include directions for companies. The employer must incorporate their title along with the organization as well as the address and date of employing. The name in the personnel ought to be mentioned as well as the employer’s recognition variety must be outlined. When the employee has numerous work total techniques 3-4 to select the greatest compensated task leaving other tasks unfilled. It is also important to include your full name as well as your social security number If you are employed at multiple places.

Develop TP1015.3-V

New staff need to complete two forms that come with The government TD1 along with Provincial TP1015.3-V. Quebec workers need to submit the government form and new employees in other provinces need to complete their provincial kind. Although most employees submit the government kind however they could possibly have to fill in equally types. If you’re a brand new worker it is recommended that you fill in all of the varieties in order to avoid uncertainty. If you’re filing taxes, ensure that you complete both forms particularly in the case of claiming a minimum personal income.

To become taxation-successful for taxes purposes, you need to consist of any taxes-deductible advantages you will get within your spend. If you are paid on a commission-based basis, you must include the commissions as part of your compensation. To do this, you should add your commission fees to your revenue, then use the regular strategy to determine provider deductions. The information you need is with the portions C and C of the form. Ensure you help save these types to be used for audit uses.

Once you document your remittances you must ensure your employer paying out the correct quantity to the appropriate time. If you pay your employees on a regular basis, every two weeks, it is necessary to submit Form TPZ-1015.R.14.3-V, for instance. If you do not fill out this form then you’ll be legally required to pay taxes on compensation for that period. You’ll have to submit a new form in accordance with that pay period if you do not pay the correct amount.