Iowa Tax Revnue Employee Form – If you’re a staff member and so are unsure what you must fill in about the taxes forms for employees varieties There are certain things you need to be aware of. It is essential to keep in mind the name from the employer, their state Withholding allowances, the State, along with the due particular date from the varieties. At that time you complete this submit, you’ll be able to master the basics. You should in no way miss anything! We’ve equipped this informative guide that can assist you in your vacation. Iowa Tax Revnue Employee Form.

Employer

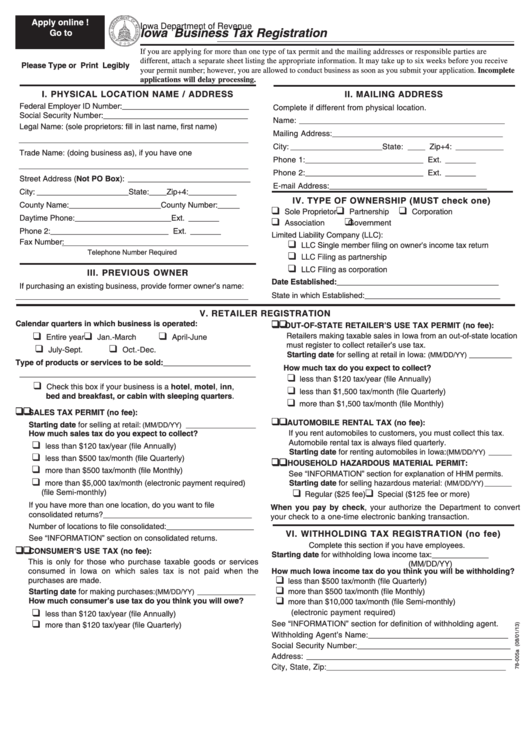

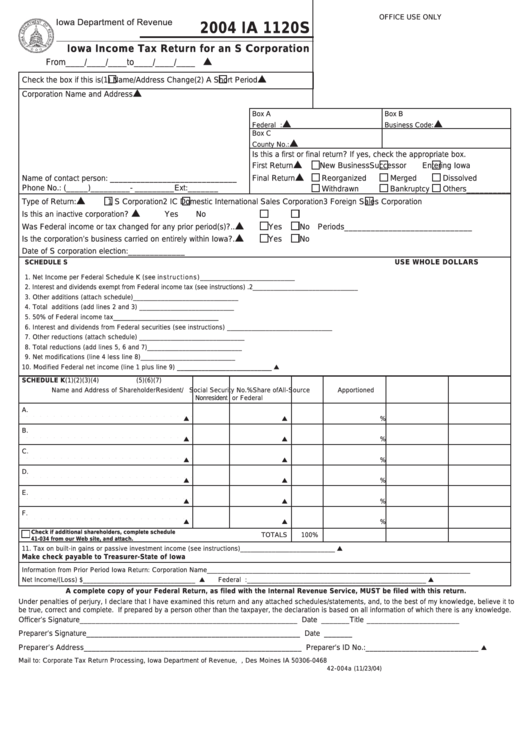

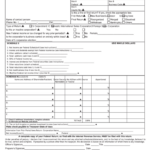

Companies As being an workplace, you must be familiarized of the a variety of tax forms along with the output deadlines to submit the types. Kind 940 is undoubtedly an yearly form which calculates the federal income taxes you have to pay on work. If they make payments to employees exceeding $1500 or give them some time for more than 20 weeks, employers are required to complete this form every year. Develop 941 is surely an yearly form that lists the income tax and also Sociable Stability taxation withheld in the employee’s salary. The shape also details just how much FUTA fees you need to pay out. FUTA income taxes needs to be paid out each and every year by the employer, as well as the type is going to be employed to submit the tax to the IRS.

It’s crucial to fill out the proper forms if you’re a new employer. In Pack B, Type IT-2104 informs businesses what level of Ny Condition and Yonkers taxes they are going to withhold. The greater number of allowances a staff member is entitled to, the significantly less taxation they are withheld. Pack D contains almost every other documents associated with taxation. Also, it is needed in order to statement any costs or cash flow promises the worker submitted. If the self-employed worker is employed then you should use the form DE 1378A is to be utilized. If you are a business with LLC members or partners who manage the company then you must make use of the form DE 1378DI.

Express

The state Employee Tax kinds are lawfully needed to be completed and handed to businesses. These types should be completed by all new staff to ensure that they’re capable to be used. The data you provide may be used to estimate payroll for workers. Besides federal types employers may well be required to acquire taxes from the state on varieties. As an illustration, employers that are based in Washington DC City of Washington DC need to record wages received in the city on taxation forms. It is a brief information on how to complete the tax varieties for workers who work in that City of Washington DC.

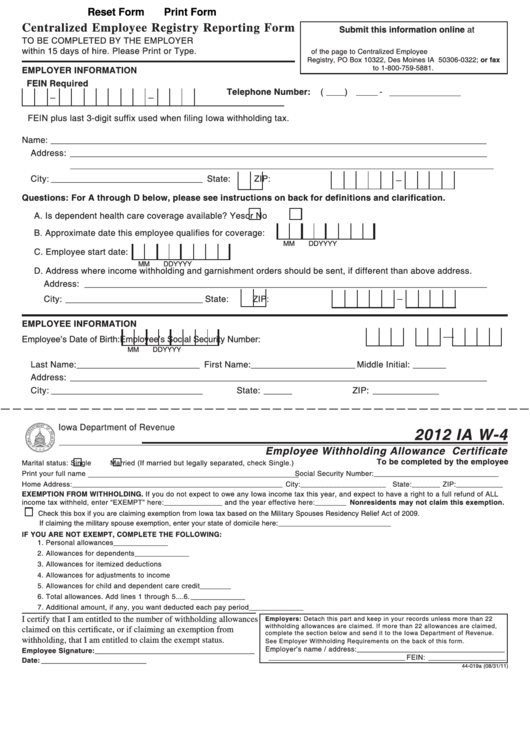

Companies need to fill out condition W-4 varieties each year for each and every new employee. These forms are required to be filled out by employees in order to ensure that the appropriate amounts of tax owed by the state are deducted from their wages. These varieties act like that from america Form W-4 they are employed by employees and employers to determine the volume of income tax due. Some says may require an added form to be finished to pay for distinct situations. In cases like this employers must ask with the human resources section of their firm to ensure they have got each of the required condition varieties are updated and precise.

Withholding allowances

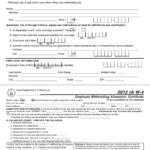

Whenever you document your federal taxes, you may need to provide information on the allowances for withholding. Simply because particular deductions is effective in reducing the volume of approximated income tax-insurance deductible revenue you state. The estimations utilized to compute withholding allowances consider the reductions. In case of declaring too little allowances, it could result in the payment of the return. It could result in tax debt when tax season comes around if you claim too many allowances. Use your W-4 Calculator to figure out how your allowances affect your taxation requirements.

You are able to easily establish the government withholding income tax factor classification by learning the rules which are in Form W-4. You may then modify the amount withheld to be sure that neither of the two you or even the taxing influence must pay an past due harmony in the close up each year. The decision to reduce your taxation deduction more or less is contingent around the amount of your revenue are low-salary. You can pay estimated tax monthly payments for Tax Department if you don’t have to pay the entire amount of your earnings. Tax Division.

Due date

The time frame for giving employees with income tax types is around the corner. Form W-2 has to be handed out to employees before January 31st 2022. Employees who cease operating prior to the timeline may still purchase an original variation in the develop. If not, the employee has to ask for a copy of the form in the first 30 days of making a request. If, even so, the employee requests a duplicate before expiry particular date, employers must give the form to the worker. The deadline for releasing the varieties can also be established each day the employee will make a request it.

The Internal Income Service (Internal revenue service) has stringent suggestions to the circulation to employees in the form W-2 kind. Often, it is actually described “Wage and Tax Document,” this form is used by companies to history the income staff obtain and the income taxes which can be subtracted from the wages. Businesses must full and give the shape to any or all staff by the 31st of January to allow workers time to comprehensive fees. Additionally the shape is definitely an information source that can be used by staff members from the Sociable Protection Supervision.

On the internet access

Employers are able to give employees with ease of access to W-2 taxation varieties online. When a worker is enrolled to the program and possesses enrolled they will be informed through electronic mail notifying them that the tax varieties are for sale to down load. Before accessing taxation types make sure you confirm the property street address along with individual email address with UCPath online. On January 10, 2022 most employees should have the two Varieties W-2 kinds and also 2 1095-C forms. You are able to see the W-2s and also 1095-C kinds through On Your Assistance On the web.

Given that final Friday, companies who authorized staff members to conceal their Forms W-2 must be obtaining a computerized e mail that provided recommendations on how to available the types. If employees did not consent to the suppression of their W-2s, the paper Forms can be printed out and delivered on or before the 31st of January. There may be sufficient time to omit Kinds 1095-C along with W-2. While you wait around, it’s nevertheless possible for workers to obfuscate their income tax kinds by way of producing an online taxes.