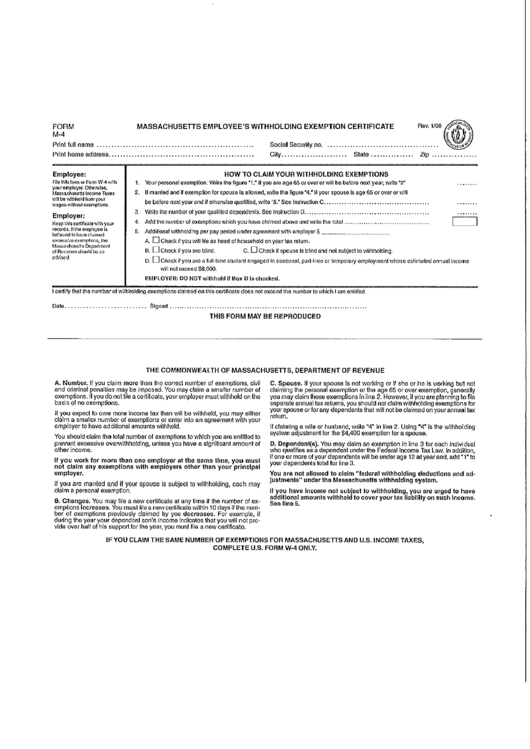

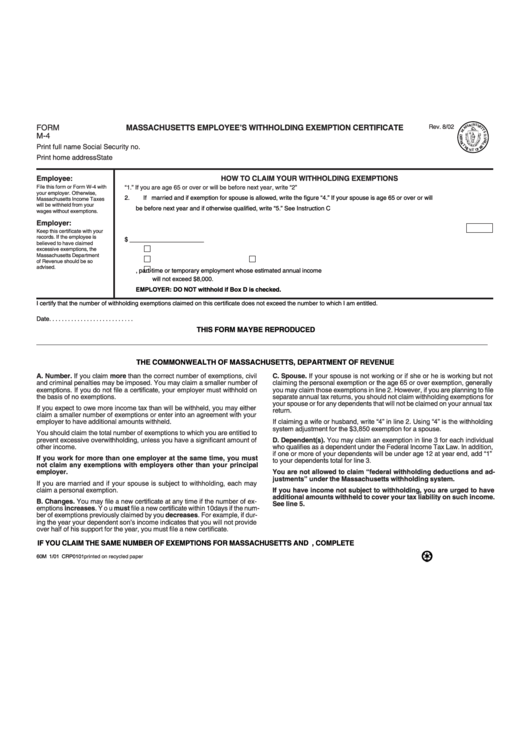

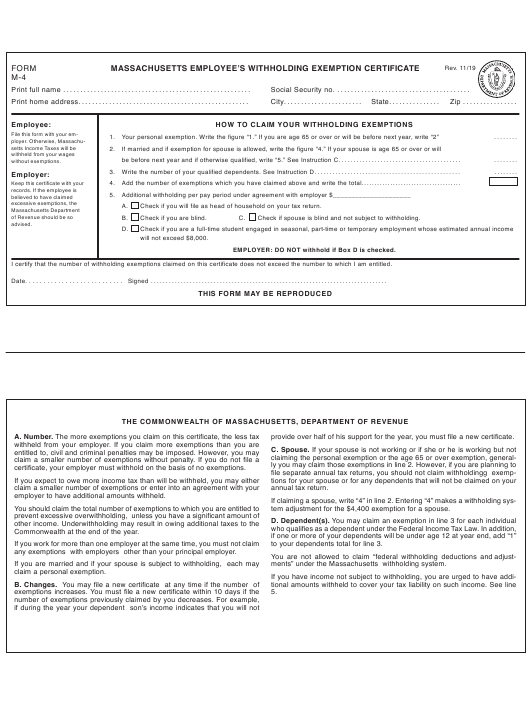

Massachusetts Form M-4 Employee’s Withholding – Maybe your enterprise recently changed your staff withholding Develop (also called”the W-4) to really make it less difficult for workers to comprehend and submit their tax statements. But, this transformation might lead to uncertainty to employees since they might not know where to locate the past year’s personalized results for taxes. To get your data, you could be needed to take a look at the employee’s individual tax come back. To create the process of declaring your tax return far more basic it is recommended that you look at the Nationwide Payroll Confirming Consortium’s policies. Massachusetts Form M-4 Employee’s Withholding.

Internal revenue service Kind W-4

It will be the IRS Kind W-4 is a type of taxation develop used by businesses to choose the level of tax withheld from the paychecks of staff members. It is actually split into two segments: a Worksheet plus the Instructions. The Worksheet delivers the important information to determine an employee’s allowance for withholding for first time York Yonkers and State taxes. If married couples file conjoint returns, directions require a calculation of wages which are in the range of $107650 to $2263,265.

The current Form W-4 doesn’t need staff members to supply the exemptions they have got on their own or exemptions for dependents. Instead, it openly asks for the quantity of dependents they already have along with the volume they may be qualified for state for every centered. It also asks if the employees wish to increase or decrease the amount they withhold. As long as the information is correct it can result in a tax withholding amount lower than what exactly is basically expected after it is time and energy to submit income taxes for the 12 months.

Varieties for withholding condition taxation kinds

You should supply your employer with status income tax withholding types for workers every year. The kinds are needed every time you get started your task. They ought to be reviewed each year to ensure you are taking the proper volume of taxation. The federal W-4 is definitely the typical form each and every personnel has to submit nevertheless, states’ forms vary a bit. You can contact your HR department if you’re not certain what forms are required in your state. Ask the HR department of your company or your employer if you’re not sure if you’re required to fill out State Tax Withholding forms or not.

Particular says need companies to supply staff members with taxes withholding kinds which could will help them know which taxation they should shell out within the express these are found. Depending on the status, you could have to collect information regarding 3 kinds of income tax. It is actually required to spread the federal and status W-4 types to every worker. Taxes withholding condition forms to staff similar with government W-4 varieties nevertheless, they could consist of distinct information and facts. Retain the kinds in a secure position and update them regularly.

Exemptions from withholding federal tax

There are a selection of taxation withholding exemptions offered to workers. The worker who lacks to spend income tax should never possess income tax-deductible revenue in the past 12 months and possess no goal of earning taxable income in the present calendar year. Other exemptions to withholding for employees are lovers who definitely have children beneath 17 years of age, and that do not meet the requirements as dependents by someone else’s tax return. But, you can not claim every exemption you will find. The exemption has to have to be applied for on a brand new Form W-4 each year in order to remain on good terms.

The W-4 form will be in effect on January first 2020. Companies can use the form to tell companies they are not subject to withholding taxes on national income. Being exempted, the worker ought not to be liable for income tax in past times year, or predict through an tax obligation for that calendar year in which they may be employed. The Form W-4 declaring exempt from withholding is merely reasonable to the work schedule calendar year which it is given. A fresh Form W-4 has to be provided to their employer before February 15th of the following year if an employee wishes to retain this exemption.

Deadlines for that declaring of forms

The Internal Revenue Support (Internal revenue service) chooses in the demands for filing withholding each and every year by analyzing your accounts spanning a 12-month period of time. The timeline to the schedule 12 months is in the 31st of Jan. Here are the essential dates to file the kinds. To ensure you’re in concurrence with one of these guidelines follow the output deadlines listed below. It can be easy to complete these types in writing or on-line form. In any case, make certain you file them by the timeline.

You must complete Form 1040 before the deadline if you’re an U.S. citizen and live outside of the United States. If you’re a non-resident alien and are currently serving within the military then you have to complete Form 4868. Form 4868 in order to delay the deadline to October 15, 2019. In order to make it through the deadline, furthermore those who are in a conflict zone may request an extension of four months.