New Employee Forms For Texas – If you’ve just recently crafted a employ You may well be looking for a place to start the primary new career Kinds. Get started with Kind I-9, Type W-4, or the TP1015.3-V. Check out the below links if you’re unsure the form you’ll need. Soon after you’ve completed the latest Varieties for workers Types then you are able to move onto these stage of hiring the employee. New Employee Forms For Texas.

Form I-9

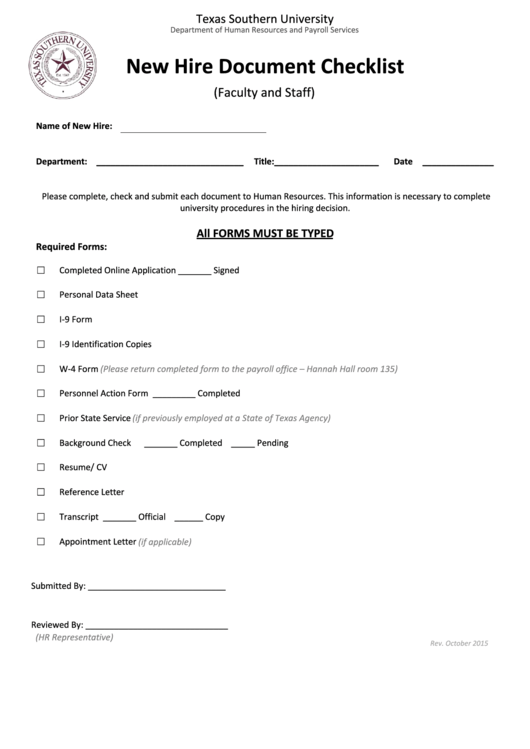

You will need to complete Form I-9 for new hires if you’re looking to hire new employees. Form I-9 for employees who happen to be new. To do this it really is required to confirm the identification of your new staff. It is a authorized prerequisite in national rules and you’ll will need one of many two instruments offered by the federal government: The Shape I-9 along with the E-Authenticate system. Unless you use one of those instruments it is probable to apply the mixture of the two.

Existing variation of I-9 for workers who definitely are a new comer to the organization expires on March 31, 2016. You must keep it in use till the updated form becomes available or wait until additional guidelines are issued if you plan to keep using it. The end date of the form on the form itself, or on the USCIS website. Consult an employment lawyer for a review of the latest Version that is on the form if you’re not sure the current version of Form I-9 will be valid for you.

Companies, you will need to be sure that the details on Develop I-9 is right. Type I-9 is proper. He or she should correct the error if the employee has made a mistake in Form I-9. Form I-9, then he need to particular date and signal the appropriate type. Failure to adhere to federal government rules can be quite a cause of charges. To ensure the precision of Form I-9, make certain there are replicates of the your papers. Whenever you employ someone that doesn’t hold every one of the over papers it is advisable to retain the services of person who has them.

Kind W-4

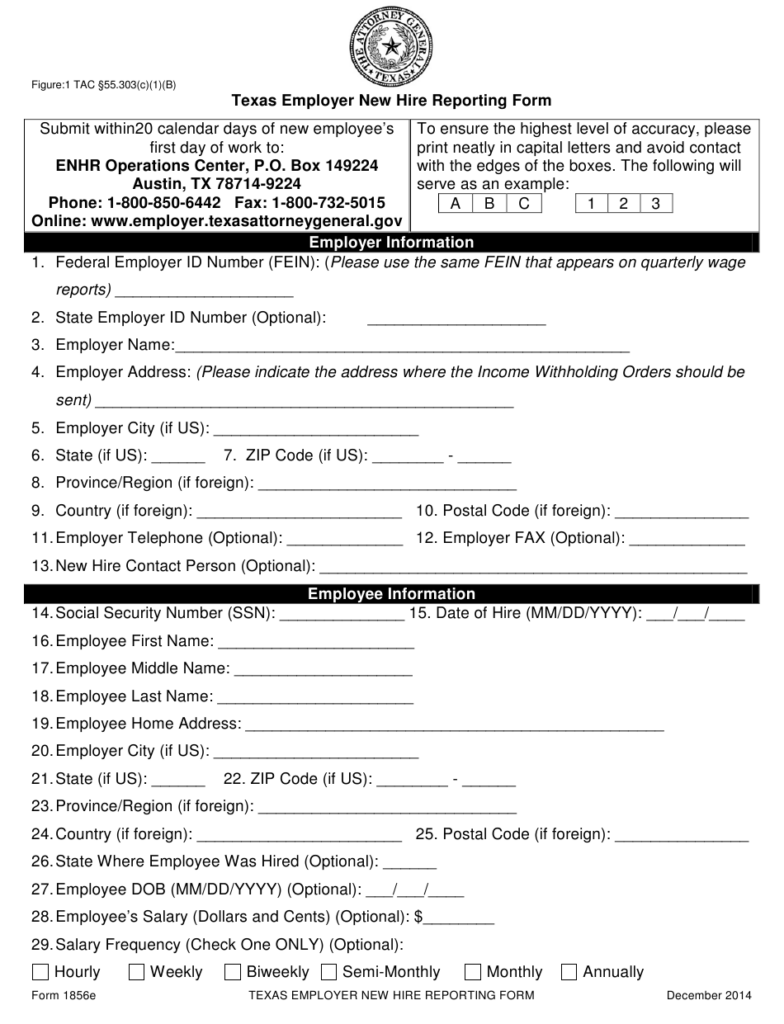

If you’ve recently begun at a brand new position, then you’ll have to fill out a brand updated Form W-4. When an employee is transferred to new jobs or goes through an amendment in circumstances and circumstances, the Form W-4 needs to be adjusted. The IRS obliges people to pay their taxes in slow payments throughout the year, which means if there’s excessive in taxes that are withheld from your salary and you are unable to pay it, you could be paying a substantial amount in April, not forgetting penalty and interests. It’s necessary to follow the time frame, no matter what regardless of whether you’re a new worker or perhaps an pre-existing one particular.

The shape must be completed and then published to the taxes agencies that happen to be proper. Within the NYS Taxes Office, W A Harriman Campus, Albany, NY 12227-0865, requires businesses to send out an authentic backup with this develop to the Internal revenue service. Box B have to have information on how to handle new employees. If the employer is unable to deliver the form through U.S. mail, he or she must consult Publication 55 for further information. The Internal Revenue Service provides an estimator of income tax withholding to assist employees determine their withholdings.

The shape should also include guidelines for businesses. The employer need to consist of their label along with the company plus the address and date of using the services of. The label in the personnel should be talked about and also the employer’s detection quantity needs to be outlined. In case the personnel has a number of careers full methods 3-4 to choose the very best compensated career and leave other tasks unfilled. It is also important to include your full name as well as your social security number If you are employed at multiple places.

Form TP1015.3-V

New employees must total two forms that come with The federal TD1 as well as Provincial TP1015.3-V. Quebec employees need to submit the government kind and new staff in other provinces need to complete their provincial type. Despite the fact that most staff fill out the federal form nevertheless they could have to fill in the two types. If you’re a new worker it is recommended that you fill out all the forms to prevent uncertainty. Ensure that you complete both forms particularly in the case of claiming a minimum personal income if you’re filing taxes.

To be taxation-efficient for taxation reasons, you need to involve any tax-insurance deductible rewards you will get within your pay. If you are paid on a commission-based basis, you must include the commissions as part of your compensation. To carry out this, you have to add your commission fees to your income, after which utilize the regular strategy to calculate provider write offs. The information you need is within the parts C and C of the kind. Make sure you save these forms for use for review purposes.

If you file your remittances you must be sure that your employer spending the correct quantity for your proper time. For instance, if you pay your employees on a regular basis, every two weeks, it is necessary to submit Form TPZ-1015.R.14.3-V. You’ll be legally required to pay taxes on compensation for that period if you do not fill out this form. You’ll have to submit a new form in accordance with that pay period if you do not pay the correct amount.