Ohio Employee Withholding Deposit Form – Possibly your enterprise has changed your personnel withholding Type (also referred to as”the W-4) to really make it less difficult for employees to comprehend and submit their tax statements. But, this modification might cause confusion to staff members since they may not know where to locate the past year’s personal profits for income taxes. To get the information, you could be necessary to analyze the employee’s individual income tax give back. To make the procedure of declaring your taxes a lot more easy our recommendation is that you look at the National Payroll Reporting Consortium’s guidelines. Ohio Employee Withholding Deposit Form.

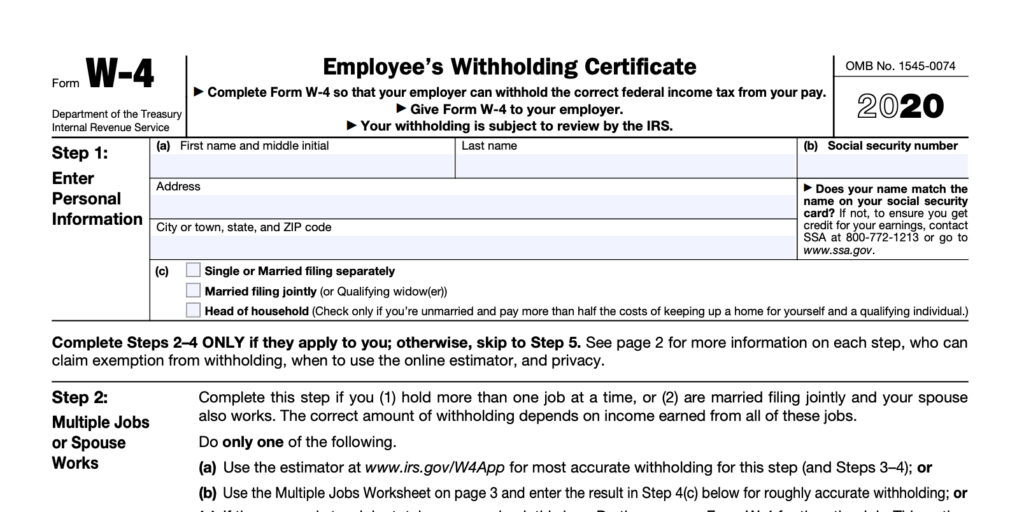

IRS Kind W-4

This is basically the Internal revenue service Type W-4 is a type of taxes type utilized by organisations to decide the volume of taxes withheld in the paychecks of staff members. It can be divided into two segments: a Worksheet as well as the Instructions. The Worksheet delivers the necessary information to estimate an employee’s allowance for withholding for New York Yonkers and State taxes. If married couples file conjoint returns, directions require a calculation of wages which are in the range of $107650 to $2263,265.

The up-to-date Kind W-4 doesn’t call for workers to provide the exemptions they have on their own or exemptions for dependents. Instead, it requests for the amount of dependents they already have and also the amount they are eligible for declare for every based. It also asks if the employees wish to increase or decrease the amount they withhold. Given that the data is correct it will result in a tax withholding quantity less than what is in fact because of when it is time to data file fees for the season.

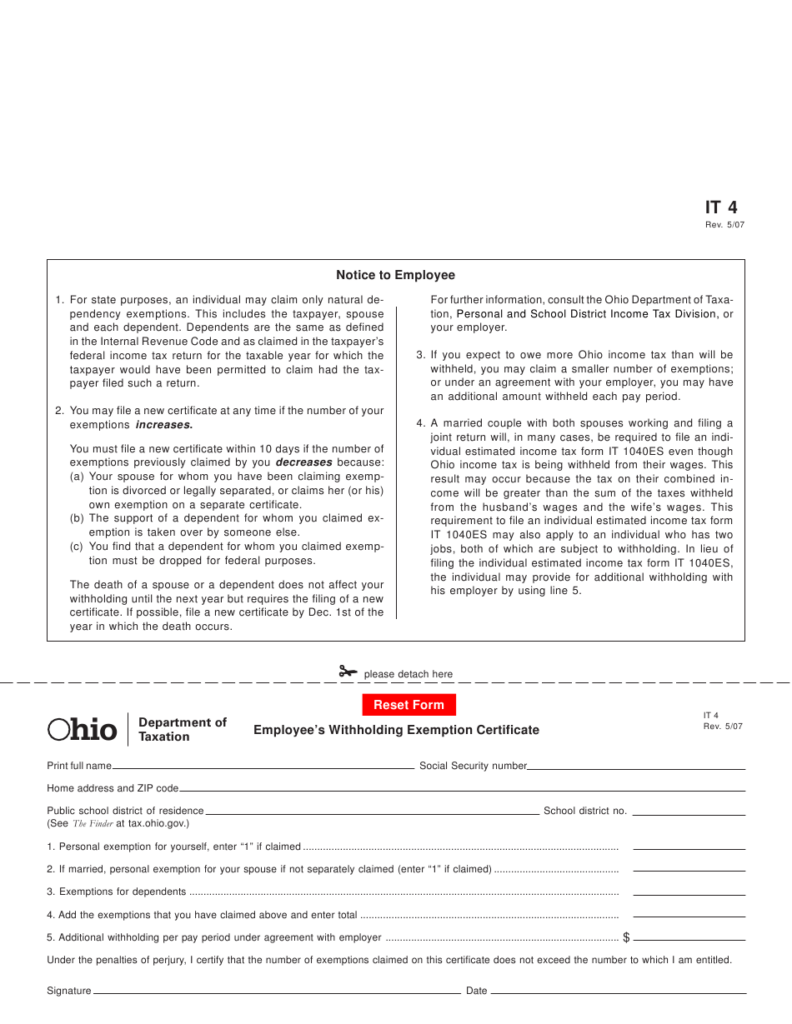

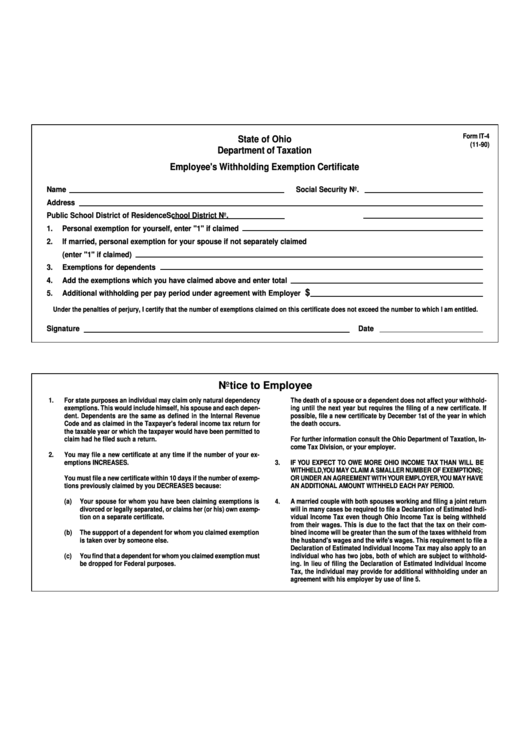

Kinds for withholding express taxation varieties

You need to provide your employer with condition taxes withholding forms for workers every year. The forms are essential any time you begin your brand new career. They ought to be analyzed annually to make sure you take the right level of taxes. The government W-4 is definitely the common kind each and every personnel has to submit however, states’ varieties vary somewhat. If you’re not certain what forms are required in your state, you can contact your HR department. If you’re not sure if you’re required to fill out State Tax Withholding forms or not, ask the HR department of your company or your employer.

Specific says demand companies to provide staff members with tax withholding types which may may help them know which taxes they need to shell out from the status they can be found. In line with the state, you could have to gather specifics of about three types of income tax. It is essential to spread the federal and state W-4 kinds to every single employee. Income tax withholding condition forms to staff similar with government W-4 types however, they can have certain info. Maintain the types in the secure position and up-date them frequently.

Exemptions from withholding federal income tax

There are a number of taxes withholding exemptions offered to employees. The employee who lacks to pay for taxes should never possess tax-deductible revenue from your previous season and possess no aim of earning taxable earnings from the current year. Other exemptions to withholding for employees are partners who may have youngsters below 17 yrs old, and that do not meet the criteria as dependents by a person else’s tax return. But, you cannot state every exemption you will find. In order to remain on good terms, the exemption has to have to be applied for on a brand new Form W-4 each year.

The W-4 kind are usually in result on January primary 2020. Employers are able to use the form to tell businesses they are not subjected to withholding income tax on federal cash flow. To become exempted, the worker should not be responsible for tax before year, or foresee having an taxation responsibility to the calendar year in which they can be hired. The Form W-4 declaring exempt from withholding is only legitimate to the calendar calendar year which it is actually given. A fresh Form W-4 has to be provided to their employer before February 15th of the following year if an employee wishes to retain this exemption.

Work deadlines for your filing of types

The Inner Earnings Support (Internal revenue service) determines on the requirements for declaring withholding each and every year by examining your accounts more than a 12-month time period. The timeline to the work schedule 12 months is around the 31st of January. Listed below are the essential days to submit the forms. To ensure you’re in concurrence with these regulations adhere to the due dates shown below. It is actually possible to fill in these varieties in writing or on the web type. In either case, ensure that you submit them with the timeline.

You must complete Form 1040 before the deadline if you’re an U.S. citizen and live outside of the United States. If you’re a non-resident alien and are currently serving within the military then you have to complete Form 4868. Form 4868 in order to delay the deadline to October 15, 2019. In order to make it through the deadline, furthermore those who are in a conflict zone may request an extension of four months.